What Life Insurance Products are you interested in?

Select All that Apply

The ease of getting insurance with

Ben and Sylvia Williams

Our Modern, 100% online experience makes applying

super fast and stress-free.

Coverage up to $2M with no medical exam. Just answer a few simple health questions.

Legal Shield for wills & estate plans. Eligibility depends on the product and state.

95% of qualified applicants get instantly approved in 10 minutes or less.

Flexible options to fit different budgets and needs because life insurance isn't a one-size-fits all

Dedicated support from our team. We're committed to helping you find the right coverage.

Get a 30-day money back guarantee. If you're not fully satisfied in the first 30 days, we'll refund you in full.

Backed by Giants

We work with the largest trusted life insurance companies in the industry

Your Top life insurance questions answered

Life Insurance

What is life insurance?

A way to provide for your family if something happens to you.

Life Insurance

How much life insurance do I need?

We'll help you decide. Try our calculator to start.

We'll help you decide. Try our calculator to start.

Life Insurance

How Much Does It Cost?

It's a monthly payment between about $7 and $x a month.

Frequently-Asked questions

How much does life insurance cost?

Most people overestimate the cost of life insurance by

300% or more. The cost varies based on your unique situation. The biggest factors that can affect your premium include your coverage amount, term length, age, health status, and tobacco use. The sooner you buy, the sooner you’ll lock in your lowest premium—and save the most money in the long run.»

What if I already have life insurance through my employer?

Employer-sponsored policies typically offer coverage that is about 1-2X your annual salary, which is a fraction of what most families need. And if you leave your job, that coverage usually ends. A common rule of thumb is to have 10X your salary in life insurance protection, which is why many people buy individual term policies to supplement their coverage through work.

How much life insurance do I need?

A common and easy way to come up with a coverage estimate is to multiply your annual income by 10. Another way is to calculate your long-term financial obligations and then subtract your assets. The remainder is the gap that life insurance needs to fill.

Why Buy Term?

Term life insurance

uses premiums to cover you for the determined “term” of the policy. Coverage expires if there is no claim within that time frame. Term life can be a good match for someone seeking affordable coverage to replace lost income over a critical period, such as while raising children or paying off a mortgage. Because Term is more reasonable than Whole Life you are able to Open up up the three Fundamental Accounts to save for and Emergency, large Purchase and Retirement without it affecting the face value of your policy for the same amount you would pay for a Whole Policy in where if you borrow against the cash value will take away from your coverage amount.

What does life insurance cover?

Your life insurance can help cover some of life's biggest expenses if you pass away while the policy is in force. For instance, policy proceeds are often used for mortgage payments, debts, tuition, and everyday expenses. Ultimately, it's up to your beneficiaries to decide how to use the payout. Proceeds are paid in a lump sum and are generally tax-free.

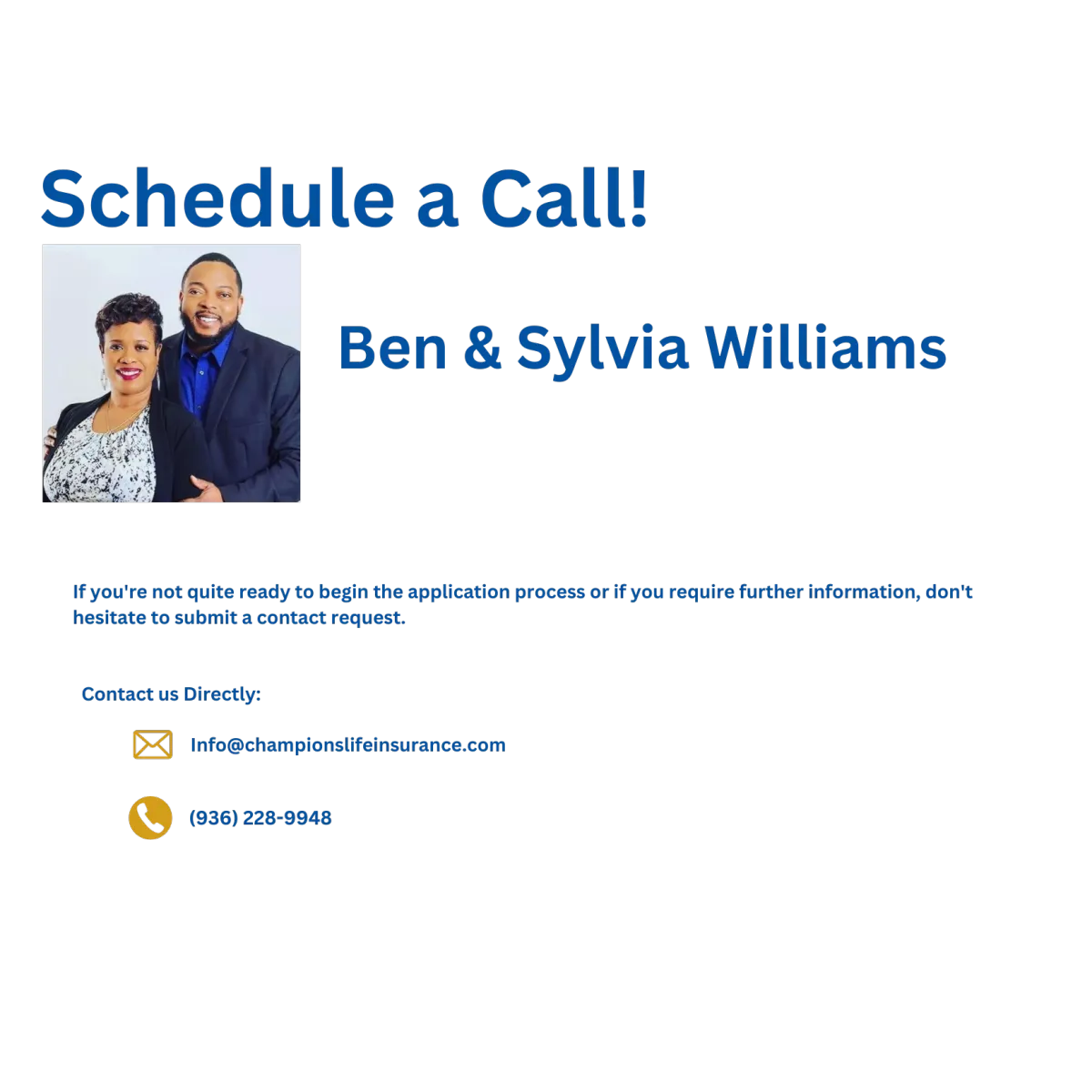

Get started

Take the first step towards protecting your family and apply for life insurance online with Ethos.

Contact Us

140 Cypress Station

Spring, TX 77090

Phone: 936-228-9948

Your privacy is important to us. This site uses cookies and other technologies to enable and improve functionality and marketing, analyze site use, and generate analytics. See our Privacy Policy for details. By using this site, you agree to our Terms of Use and Privacy Policy.